With Best Medicare Supplement plans 2023 limits will no longer be a part of your life

The occasions of existence are surprisingly changeable, and whenever it confronts us with all the terrible instances, it is in which it can not force us to provide crucial fights. With regards to overall health, there exists nothing far more exasperating than an monetary concern that shuts you with potentially essential alternatives to get free from the situation, such as instant competent medical treatment and medications necessary in an emergency, among others.

You could certainly be paid by Medicare health insurance, the United States’ administrator, interpersonal stability protection software. If so, the recommendation is to get the Best Medicare Supplement Plans 2023 and provide more protection for your solutions.

Obtaining it gives you a lot more protection

Medicare health insurance is ideal for seniors and youth who be eligible for a addition inside the plan. Their services undoubtedly let them have a lot more security and self confidence concerning health issues.

However, being a community service, it bears with it a number of limits speaking when it comes to insurance coverage. For this reason the significance of possessing Medicare Supplement Plans 2023 adapt to your health care and financial situation. It depends on one to examine and discover the organization that provides you the services at the greatest price.

Assortment of choices from the insurance market

It is essential to know that most companies provide the very same support at different costs inside the insurance marketplace. Medicare Supplement Plans 2023 do not fluctuate inside their circumstance nevertheless the selling price made available from insurance firms. This is why you must look for in more detail until you reach the business which gives you the greatest charge.

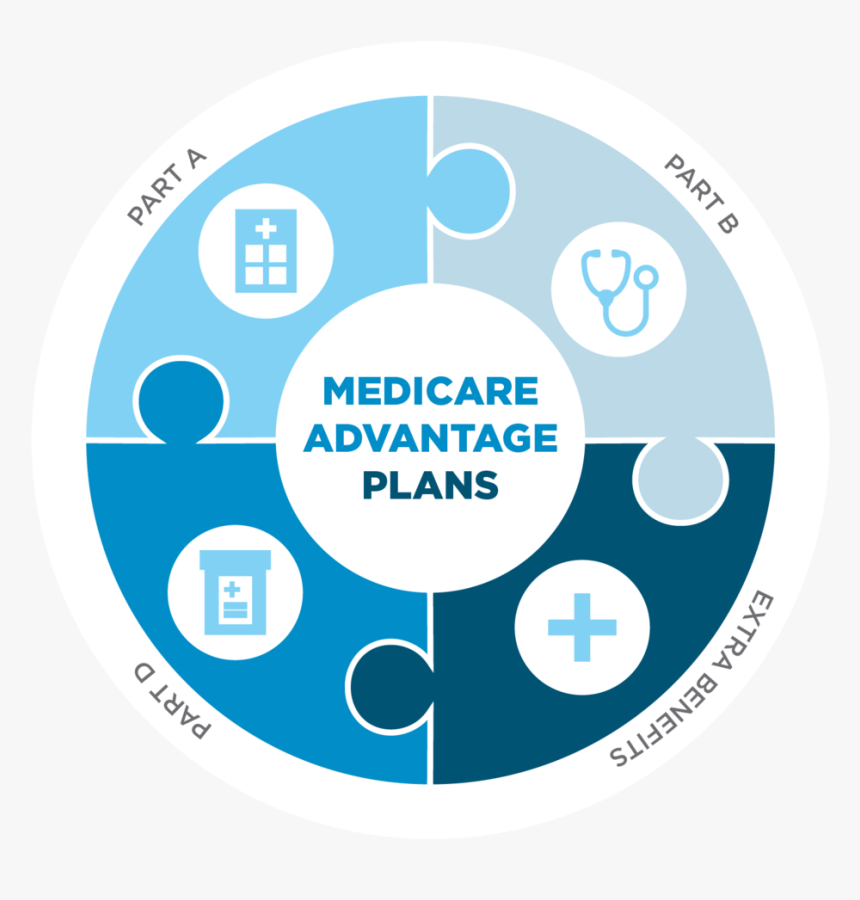

The most effective Best Medicare Supplement plans 2023 or Medigap are undoubtedly a tremendous edge on the basic system. These strategies are specified by words like a, B, C, D, F, G, K, L, M, and N, with strategies A and N simply being the ideal dealers. The difference between the two is actually within their coverage. Some tend not to protect:

•Coinsurance,

•Part A and part B insurance deductibles.

•Overseas travel emergency situations.